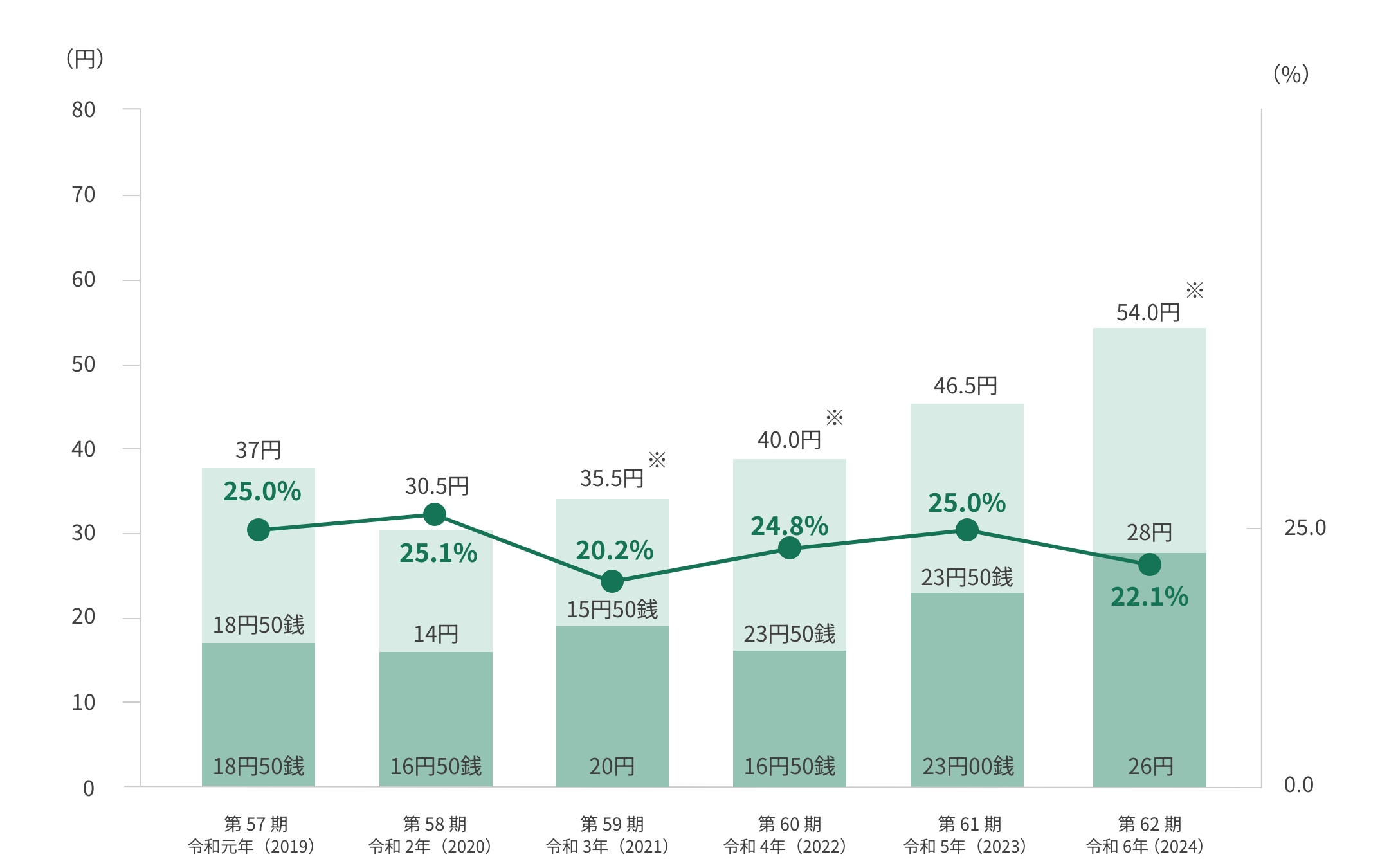

配当金の基準について

中間と期末の年2回、下記の基準により配当を実施いたしております。

安定配当として下限を設けたうえで、一定の基準を超えた当期(中間)純利益が計上された場合、

連結配当性向を25%として業績に連動した配当を実施いたします。

なお、決定した1株当たり年間配当金が前事業年度の1株当たり年間配当金を下回る場合、親会社株主に帰属する当期純利益に、該当期の減価償却費の一部(減価償却費×最大10%)を加算し、連結配当性向を25%として配当を行います。

| 1株当たり当期(四半期)純利益 | 40(20)円を上回る場合 | 40(20)円を下回る場合 |

|---|---|---|

| 年間(中間)配当金 | 1株当たり当期(四半期) 純利益×25% |

10(5)円 |

| トラスコ善択配当 (独自の配当方針) |

決定した1株当たり年間配当金が 前事業年度の1株当たり年間配当金を下回る場合 |

|

|---|---|---|

| 親会社株主に帰属する当期純利益に、 該当期の減価償却費の一部(減価償却費×最大10%)を加算し、 連結配当性向を25%として配当を行います。 |

||

注1) ()カッコ書きは中間期の計算基準であります。

注2) 計算上の銭単位端数については50銭刻みで繰上げます。 1〜49銭→50銭、51〜99銭→1円

注3) 事業活動に直接の関わりのない特殊要因により親会社株主に帰属する当期純利益が大きく変動する事業年度については、その影響額を除外し、配当額を決定します。

株式の状況

※第59期~第62期に関しては事業活動に直接の関わりのない不動産・株式売却、及びその他特殊要因による影響額を除外しています。

第54期より配当金の決定に関しましては、ホームページ上でご確認をいただいております。

配当金の詳細は決算短信をご覧ください。

株式に関するお問い合わせ先

〒105-0004

東京都港区新橋四丁目28番1号 トラスコ フィオリートビル10階

トラスコ中山株式会社 東京管理課

TEL:03-3433-9830

FAX:03-3433-9881

E-mail:info@trusco.co.jp